south dakota property tax exemption

If the county is at 100 of full and true value then the equalization factor the number to get to 85 of taxable value would be 85. For more information contact the Department of Revenue at 1-800-TAX-9188 or visit their website at httpsdorsdgov.

Illinois Quit Claim Deed Form Quites Illinois The Deed

Click here for a copy of the Department of Revenue letter regarding Sales Tax Exemption.

. There are two sections in the South Dakota Constitution that provide property tax exemptions. Article XI 5 provides a property tax exemption for property of the United States and of the state county and municipal corporations both real and personal Article XI 5 is self-executing and needs no statutory language to put the. The state sales and use tax rate is 45.

Summary of South Dakota Military and Veterans Benefits. Department of Revenue Exemption Application. All sales of tangible personal property and services are subject to the state sales tax plus applicable municipal tax unless exempt from.

Of the previous calendar year. The property subject to this exemption is the same property eligible for the owner-occupied classification To be eligible. The current pay base is 15000 with rates ranging between 12 and 60.

You must have owned a house for at least three years OR Have been a resident of South Dakota for at least five years. Exempts up to 150000 of the assessed value for qualifying property. The property must be owned and occupied by a disabled veteran.

Application for property tax exempt status sdcl 10-4-15 application must be filed with director of equalization by november 1 for consideration during county board of equalization the following year state of south dakota assessed in the name of. State law provides several means to reduce the tax burden of senior citizens. The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services.

Additionally the disability has to be complete and 100 related to military service. County of _____. Calling the Sioux Falls VA Regional Office at 1-800-827-1000 and asking them to send you a statement.

Other South Dakota property tax exemptions include the disabled veterans exemption which exempts up to 150000 of the disabled veterans property value from taxes. In South Dakota all new nonconstruction employers will pay a SUTA rate of 12 for the. SDCL 10-4-2410 states that dwellings or parts of multiple family dwellings which are specifically designed for use by paraplegics as wheelchair homes and which are owned and occupied by veterans with the loss or loss of use of both lower extremities or by the unremarried widow or widower of such veteran.

Tax Breaks and Reductions. South Dakota Property Tax Exemption. Have you lived in your single family dwelling for at least eight months.

Once approved for the exemption no further applications are needed. The property will continue to receive the 150000 exemption until the property is sold or there is a change in use. South Dakota offers special benefits for Service members Veterans and their Families including a property tax exemption for Veterans and their Surviving Spouses compensation for state active duty education assistance license plates hunting and fishing benefits and free or reduced fees at South Dakota State Parks.

In South Dakota all companies are required to pay State Unemployment Tax Act SUTA taxes. Under South Dakota law Andy is the user of the paper products and does not. Then the property is equalized to 85 for property tax purposes.

South Dakota state law SDCL 10-4-44 provides a local property tax exemption for renewable energy systems less than 5 megawatts in size. Article XI 5 provides a property tax exemption for property of the United States and of the state county and municipal corporations both real and personal. Andys Restaurant provides an exemption certificate to the wholesaler to purchase these products exempt from sales tax.

For additional information on sales tax please refer to our Sales Tax Guide PDF. Property Tax Exemption for Veterans and their Widow or Widower. Wind solar biomass hydrogen hydroelectric and geothermal systems used to produce electricity or energy are considered renewable resource systems.

Parcels of exempt property listed in the table. 1 be equal and uniform 2 be based on present market worth 3 have a single appraised value and 4 be held taxable unless specially exempted. Have you been a resident of South Dakota for at least five years.

Property and Sales Tax Refund Program. You must be 70 years of age or older or the surviving spouse of someone previously eligible. Sales and property tax refunds and property tax freezes are available to seniors who meet the qualifications.

Relief Programs Assessment Freeze for the Elderly and Disabled. Thereof from property taxes. Appropriate communication of any rate hike is also a requisite.

PT 38C - APPLICATION FOR PROPERTY TAX HOMESTEAD EXEMPTION SDCL 43-31-33. How to Apply Applications must be submitted annually to your county treasurer on or. For low-income South Dakotans over the age of 70 a homestead exemption allows for delaying payment of property taxes until the home is sold.

Constitutional Provisions There are two sections in the South Dakota Constitution that provide property tax exemptions. Is the above described property classified in the county director of equalization office as owner-occupied. The states laws must be adhered to in the citys handling of taxation.

Such proof can be obtained by. The property has to be their principal residence. In addition to no state income tax retired homeowners may also qualify for the states property tax relief programs.

Taxation of properties must. You must have Acrobat Reader 40 or higher to open the file. All property is to be assessed at full and true value.

All applicants must provide proof of their eligibility for this exemption. There are no local taxes or state income taxes in South Dakota. A home with a full and true value of 230000 has a taxable value 230000.

Dwelling is defined as the home garage and the lot.

Property Tax Comparison By State For Cross State Businesses

Property Tax South Dakota Department Of Revenue

Solar Property Tax Exemptions Explained Energysage

Department Of Revenue Reminds Homeowners Of Property Tax Relief Deadline Knbn Newscenter1

Property Taxes By State In 2022 A Complete Rundown

Own And Occupy A House In South Dakota A Deadline To Save On Taxes Is Approaching

/cloudfront-us-east-1.images.arcpublishing.com/gray/MUTCLK5D7JGCTIDI6PJRO3E22I.jpg)

Deadline Approaching For Elderly Disabled South Dakotans To Apply For Property Tax Relief

Property Taxes By State In 2022 A Complete Rundown

Relief Programs South Dakota Department Of Revenue

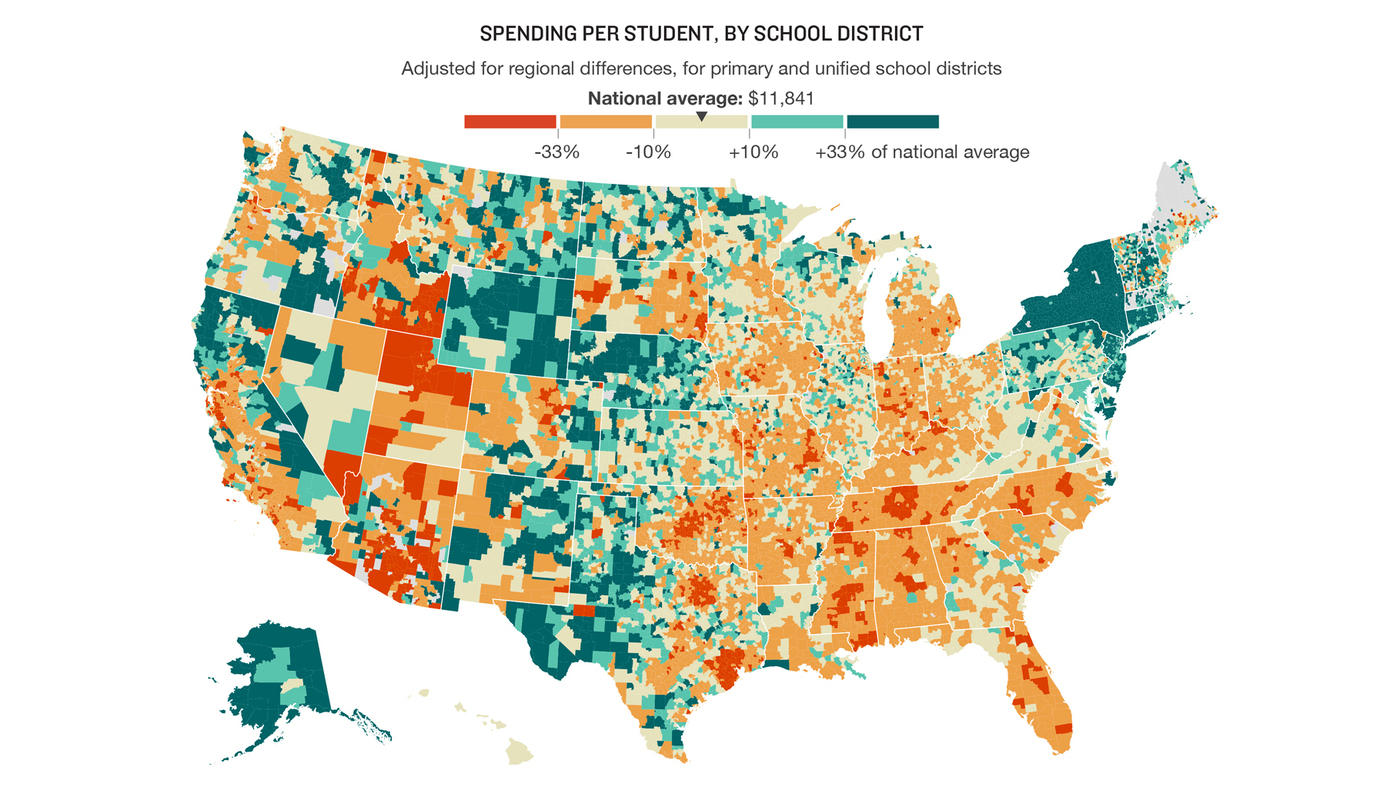

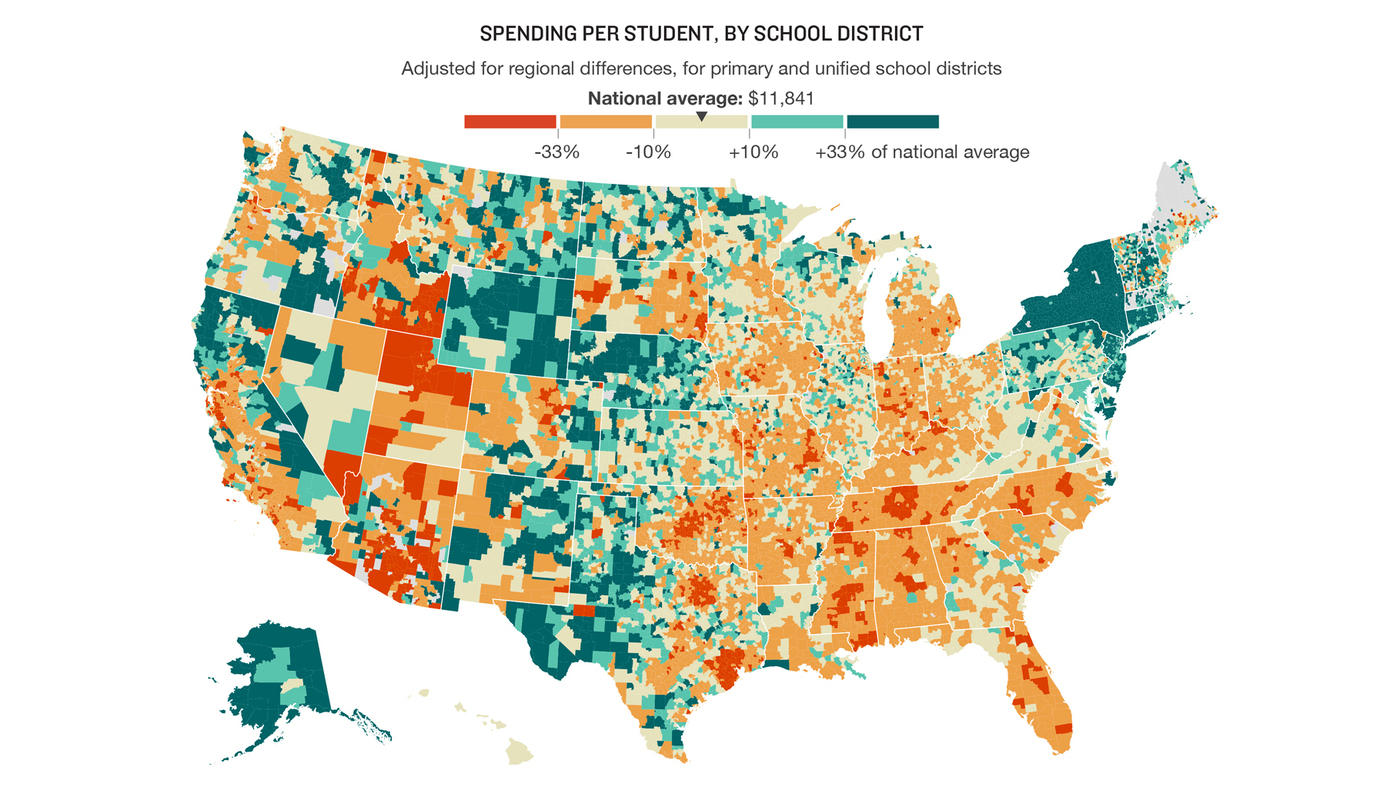

How School Funding S Reliance On Property Taxes Fails Children Npr

How Is Tax Liability Calculated Common Tax Questions Answered

Assessment Freeze For The Elderly Disabled South Dakota Department Of Revenue

Understanding Your Property Tax Statement Cass County Nd

Property Tax South Dakota Department Of Revenue

Property Tax Prorations Case Escrow

Property Tax Homestead Exemptions Itep

Understanding Your Property Tax Statement Cass County Nd

Apply For Your Sales Property Tax Refund South Dakota Department Of Revenue

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)